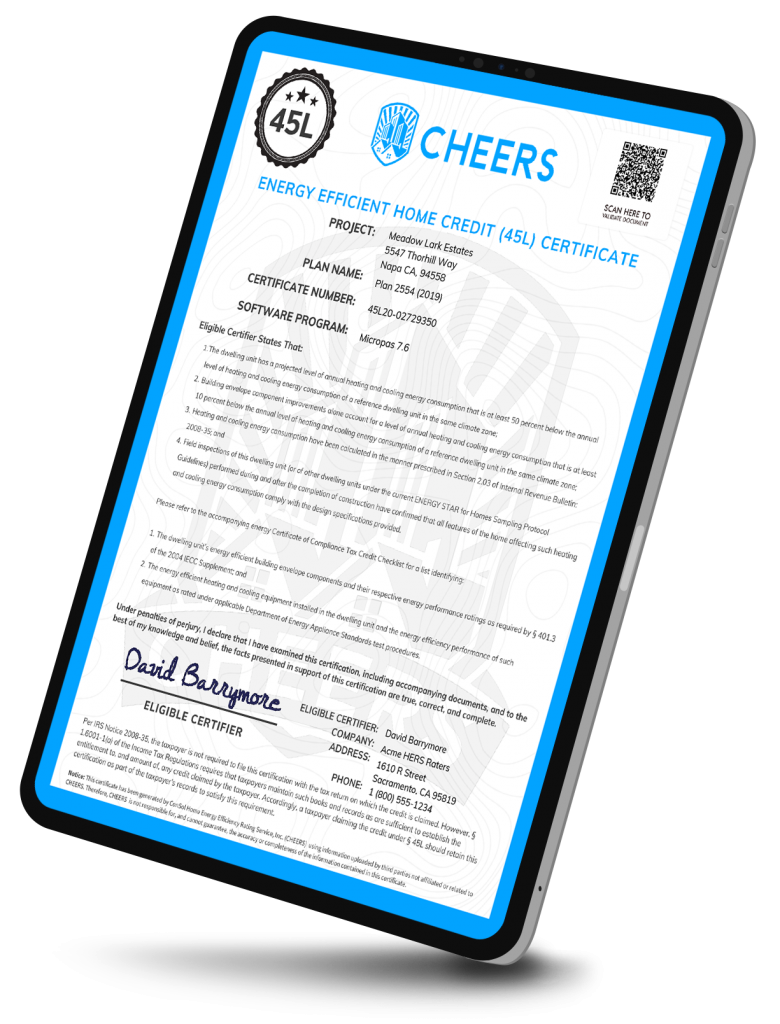

45l tax credit form

Withholding Tax Computation Rules Tables and Methods. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

The Home Builders Energy Efficient Tax Credit An Faq

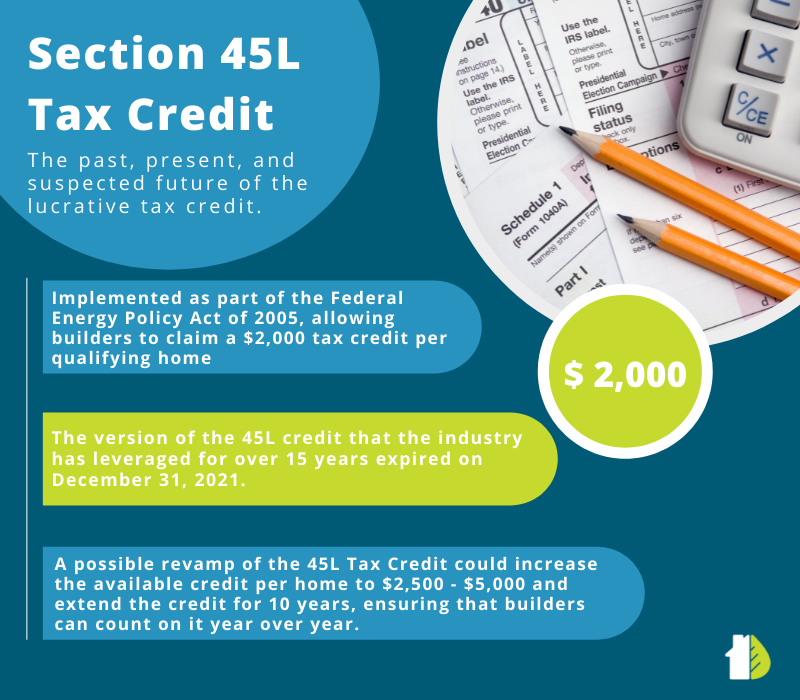

The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home 2000 per qualified home Single family and m ulti-family projects up to.

. The 45L Tax Credit originally. 45L Tax Credit Form - Tacoma Energy Products and Solutions New Home Construction. Find Forms for Your Industry in Minutes.

Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings. On July 27 the United States Senate announced the Inflation Reduction Act of 2022 which includes 36975 billion in Energy Security and Climate Change. A new budget reconciliation proposal was released on July 27 2022 and the energy provisions of the bill.

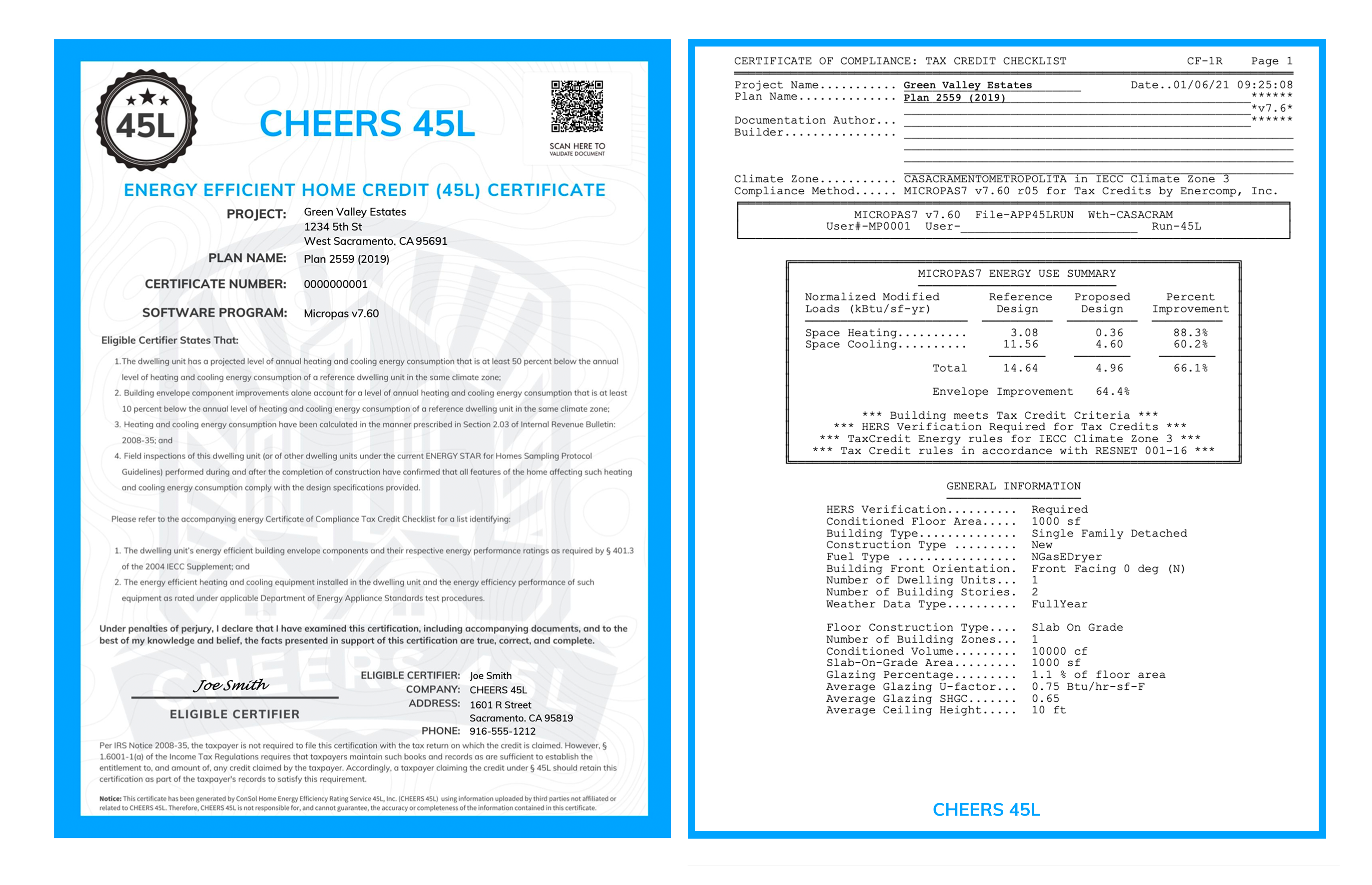

Eligible contractors use Form 8908 to claim a credit for each qualified energy efficient home sold or leased to another person during the tax year for use as a residence. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed. 45L Tax Credit 45L is for residential and multi-family properties.

We model every new home in the most cost effective energy efficient way. Jul 28 2022. Once the certifier has provided you with all the certifications you need you will have to use IRS Form 8908 Energy Efficient Home Credit to file for the 45L tax credit.

The 2000 tax credit per building unit is available to developers and builders of properties that are more energy-efficient than a. This publication contains the wage bracket tables and. Streamlined Document Workflows for Any Industry.

The allowable credit is 20 of the premiums paid during the tax year for the purchase of or for continuing coverage under a qualifying long-term care insurance policy. Upload Modify or Create Forms. Section 45L provides a credit to an eligible contractor who constructs a qualified new energy efficient home.

What is the 45L Tax Credit. The New 45L Tax Credit and How it Works Ekotrope. Use e-Signature Secure Your Files.

Ad Register and Subscribe Now to work on FRS Model Form for Credit Score Disclosure Exception. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

Ad State-specific Legal Forms Form Packages for Government Services. NYS-50-T-NYS 122 New York State withholding tax tables and methods. Check Out the Latest Info.

The Internal Revenue Code IRC Section 45L is a 2000 per dwelling unit 1000 for manufactured homes tax credit for each new energy-efficient home which is constructed by. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. The qualified contractor typically the developer builder or homeowner is the only person who can claim the 45L tax credit and must own the unit at the time of construction or improvement.

For qualified new energy efficient homes other than manufactured homes the. Try it for Free Now. Ad 45l tax credit.

Browse Our Collection and Pick the Best Offers.

45l Tax Credit Energy Efficient Home Tax Credit Tax Point Advisors

The 2 000 45l Efficiency Tax Credit What You Need To Know Attainable Home

45l Tax Credit What Is The 45l Tax Credit Who Qualifies

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Furore Over Closure Of Tax Haven The Express Tribune Tax Lawyer Tax Attorney Tax Services

45l Tax Credit Services Using Doe Approved Software

45l Tax Credit Services Using Doe Approved Software

Section 45l Energy Tax Credit Past Present And Future Ekotrope

2021 Available Tax Incentives For Energy Efficiency Cova Green Homes

Taxes Paparazzi Business This Post Is Intended To Help You Be Organized This Year And Help You With Tax Prep Paparazzi Paparazzi Consultant Paparazzi Fashion

45l Service Page Social Page Source Advisors

Taxes Paparazzi Business This Post Is Intended To Help You Be Organized This Year And Help Paparazzi Fashion Paparazzi Jewelry Displays Paparazzi Consultant