income tax calculator uk

Try out the take-home calculator choose the 202223 tax year and see how it affects your take-home pay. 20000 After Tax Explained.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Salary

UK Income Tax Calculator.

. In your case when you earn 50000. You pay tax on. At a personal income level of 125140 your entire personal allowance would have been removed.

National insurance contributions breakdown. If you earn 20000 in a year you will take home 17240 leaving you with a net income of 1437 every month. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by.

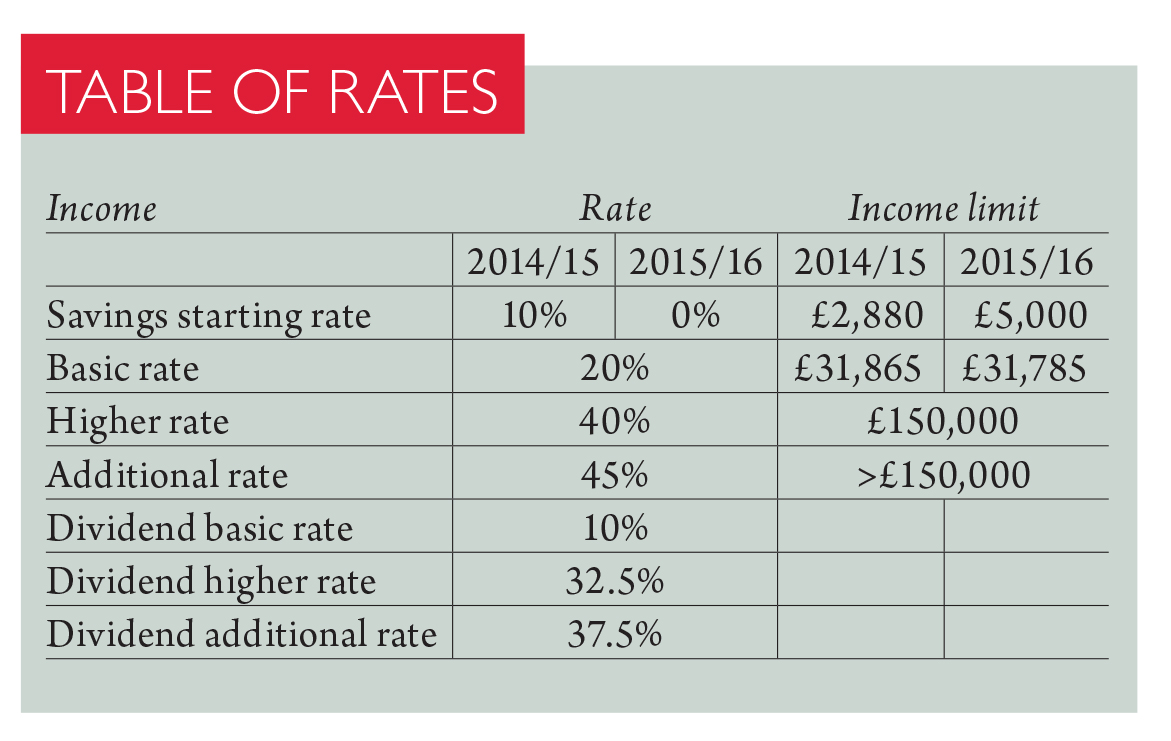

You may be able to claim other Income. Employment - SA102 FullShort. Between 50271 and 150000 youll pay at 40 known as the higher rate and above 150000 youll pay 45 the additional rate.

This tells you your take-home pay if you do not have. If you earn 40000 a year then after your taxes and national insurance you will take home 30840 a year or 2570 per month as a net salary. You pay 3549 in contributions at 9 on the next 39432.

This means If your income is greater than 100000 your personal allowance is cut by 1 for each 2 you earn above this threshold. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Based on a 40 hours work-week your hourly rate will be 1923 with your 40000 salary.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. Note that for UK income above 100000 the Personal Allowance reduces by 1 for every 2 of income above the 100000 limit. Income After Tax Breakdown UK 20000 after tax is 16981 annually based on 2022 tax year calculation.

You pay no income tax on first 12570 that you make. You pay 7286 at basic income tax rate 20 on the next 36430. More information about the calculations performed is available on the about page.

Our easy-to-use tax calculator allows you to complete your self-assessment tax return and submit directly to HMRC for the 2018-19 tax year and previous years. This is known as your personal allowance which works out to 12570 for the 20222023 tax year. The UK has a complex tax system.

You do not have to pay tax on all types of income. Highly accurate and reliable income tax calculator for UK based taxpayers with detailed information about tax National Insurance and net pay. The UK Standard Personal Allowance is tapered on income over a 100000.

Need to complete a tax return every year. This guide is also available in Welsh Cymraeg. Updated for the tax year 2019-2020.

Salary Take Home Pay. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. The reedcouk Tax Calculator calculates how much Income Tax also known as PAYE and National Insurance NI will be taken from your salary per week per month and per year.

Income Tax is a tax you pay on your income. As a result working out your income tax and other costs can become quite tricky. The total tax you owe as an employee to HMRC is 1542 per our tax calculatorYour employer collects this through PAYE and pays it over to HMRC on your behalf.

Note that your personal allowance decreases by 1 for every 2 you earn over 100000. After this you will pay 20 on any of your earnings between 12571 and 50270 and 40 on your income between 50271 and 150000. No contributions on the first 9568 that you make.

See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions. The rates are different in Scotland. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

This calculator calculates the Income Tax and National insurance based on the tax rates and bands in England Northern Ireland. Updated for the tax year 2019-2020. Unlike our salary calculator where your salary calculation results are updated in one shot here you just need to enter or slide the top gross income stick and.

This is a break-down of how your after tax take-home pay is calculated on your 20000 yearly income. Enter your salary below to view tax deductions and take home pay and figure out exactly how much money youre left with at the end of the month. The latest budget information from April 2022 is used to show you exactly what you need to know.

This is your total annual salary before any. On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate. The 202122 tax calculator provides a full payroll salary and tax calculations for the 202122 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more.

Why not find your dream salary too. Others are sent one because they have untaxed income often from property. Salary Calculator Our salary calculator calculates your income tax and national insurance contributions.

For starters everyone is entitled to earn a set amount of income tax-free. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. Now lets see more details about how weve gotten this monthly take-home sum of 1437 after extracting your tax and NI from.

Income Income Period year month 4 weeks 2 weeks week 52 weeks day 5 day week. This is the most advanced income tax calculator providing a visual breakdown of how your salary is broken up for tax and other deduction purposes. By using the calculator above you are able to calculate your income tax national insurance income from dividends student loan repayments and your total net income all based upon your income.

Wales has the same tax rates and bands as England NI for 202021. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. Hourly rates weekly pay and bonuses are also catered for.

Anything you earn above 150000. 10000 20000 30000 40000 50000 60000 70000. 20000 after tax breaks down into 1415 monthly 33000 weekly 6600 daily 963 hourly net salary if youre working hours per week.

Guide to getting paid Our salary calculator indicates that on a 16262 salary gross income of 16262 per year you receive take home pay of 14720 a net wage of 14720. If you are looking for a feature which isnt available contact us and we will add your requirements to this free payroll calculation tool.

Uk Tax Calculator Cheap Sale 51 Off Www Simbolics Cat

Income Tax Calculator Uk Deals 53 Off Www Simbolics Cat

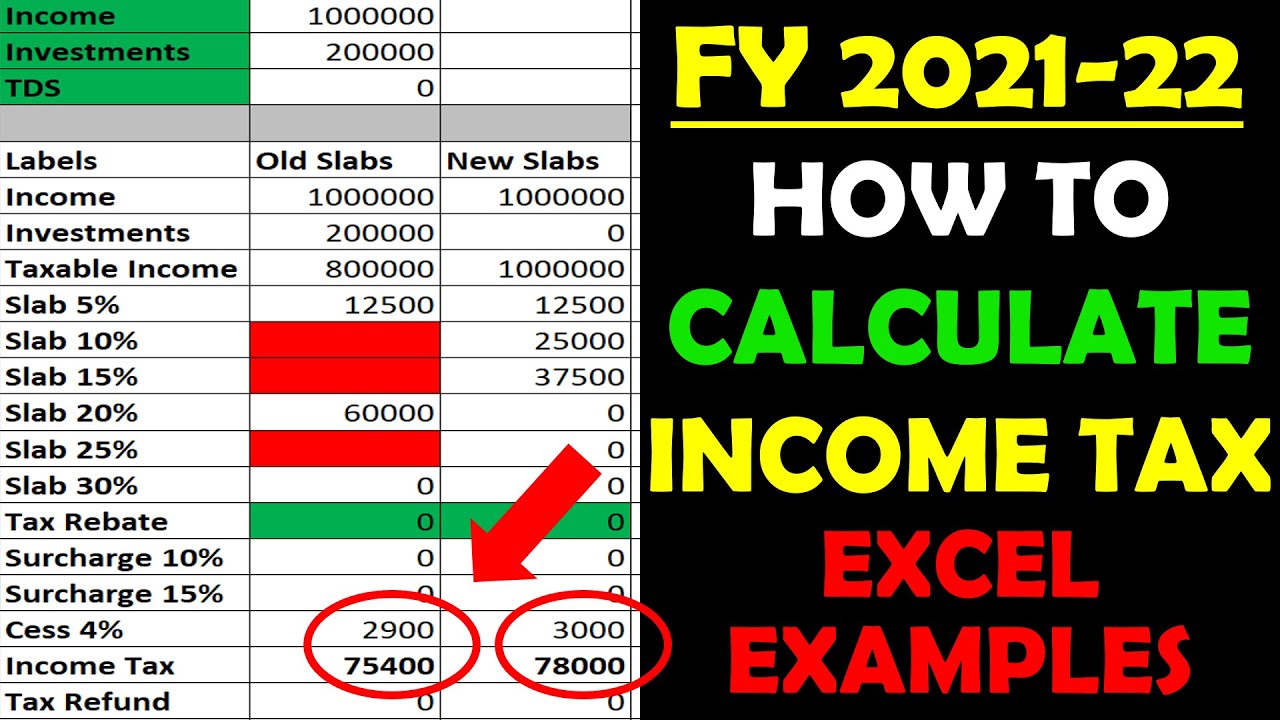

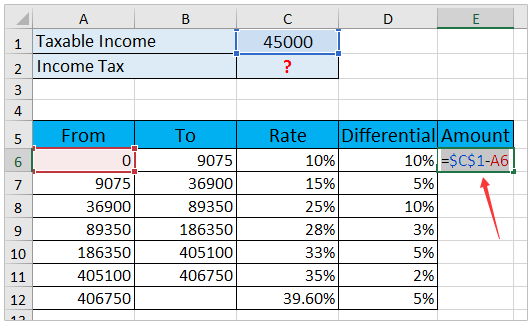

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Uk Tax Calculator Cheap Sale 51 Off Www Simbolics Cat

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Income Tax Co Uk Uk Tax Calculator Home Facebook

After Tax Calculator Sale 55 Off Www Simbolics Cat

Excel Formula Income Tax Bracket Calculation Exceljet

70 000 After Tax 2021 Income Tax Uk

How To Calculate Income Tax In Excel

Income Tax Calculator Uk Deals 53 Off Www Simbolics Cat

Income Tax Calculator Uk Deals 53 Off Www Simbolics Cat

Income Tax Calculator Uk Deals 53 Off Www Simbolics Cat

Income Tax Co Uk Uk Tax Calculator Home Facebook

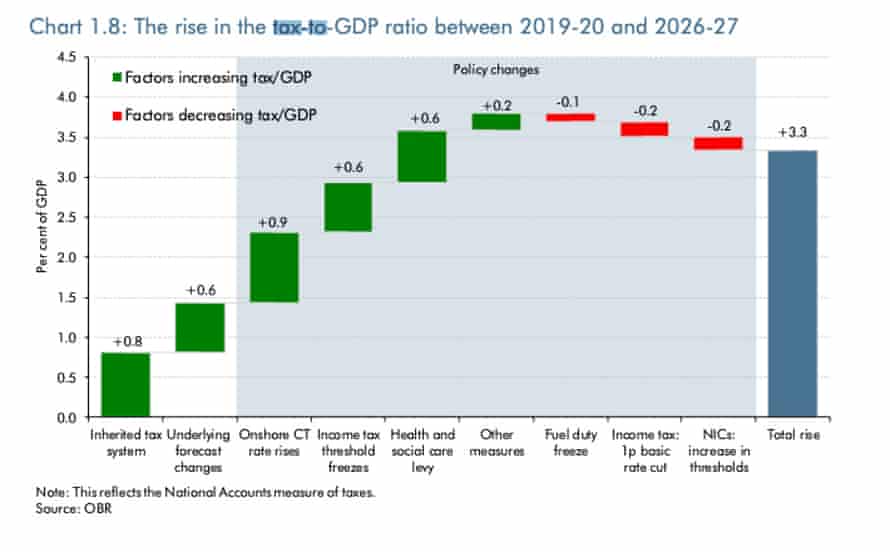

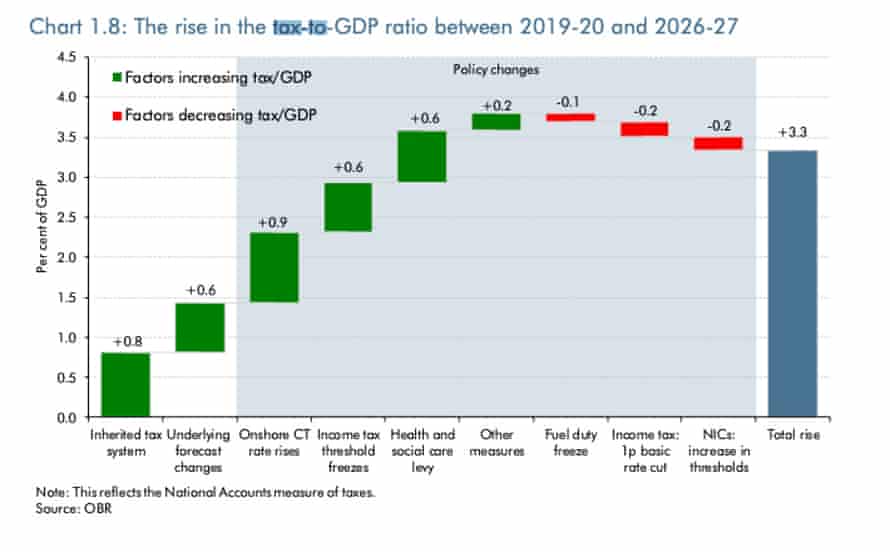

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

How To Calculate Income Tax In Excel